Addendum 5. Allocation adjustments for a bipolar presidency

Extraordinary times require reassessment.

We’re in an extraordinary stretch of economic disruption that defies reason.

Some have said that the United States’ bipolar actions on tariffs may only make sense from an aspiring authoritarian’s perspective. I don’t know if that’s true, but what I do know is that we are about to enter a long moment of precipitous economic change.

The latest bipolar moment has seen the US impose worldwide tariffs at odds with every long understood theory of economic growth and development.

Politics aside, what can we all do to marginally protect ourselves at this point?

I’ve been taking a hard look at my portfolio and thinking through the weaknesses as we navigate this ongoing era of yet more Trump who talks shit and threatens enemies, frenemies, and allies alike with economic (and real) warfare.

Fair warning here. My actions are nothing dramatic, but they are based on weeks of observing and thinking about what’s coming.

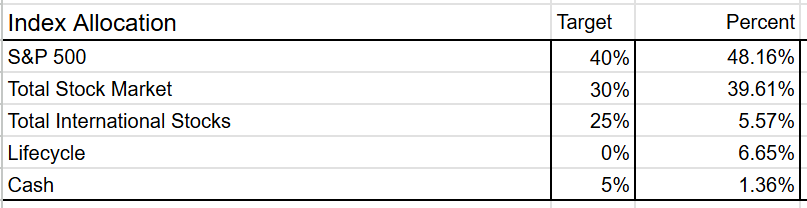

Above, you can see my current allocation and my newly revised target allocation. My international stock target is considerably higher than the 5% it was, and may yet go higher still.

Traditionally, I’ve followed the Jack Bogle philosophy of holding index funds exclusively in US equities under the theory that US companies are so dominant and so ubiquitous domestically and internationally that holding international equities is not that important as a diversification strategy.

Things are different now.

A non-exclusive list of the engines of American growth and prosperity consists of the following.

A relatively open immigration policy for scientists, engineers, and innovators from around the world as well as toleration for a certain level of informal (undocumented) immigration of unskilled migrant workers.

A consistently high allocation of government grants and other support to universities and non-profit research centers to engage in basic science that is at the heart of innovation and new product and systems development.

A policy of free trade and free capital flows that go into new businesses that build off of US government supported basic research and innovation. In other words, the opposite of trade barriers, primarily tariffs.

A policy of promoting and engendering good will and confidence in ambitious and driven entrepreneurs, both native and foreign born, as well as in the nations they come from.

This is not an exclusive list, but these will do for the present discussion.

Immigration

The ambitious and driven educated elite will not tolerate the Russian roulette that they’ve recently been subjected to at our borders. The reality is that people are being denied entry, detained, or advised not to leave the US because they might not be let back in due to their personal beliefs and prior political expression, no matter from how long ago.

Educated people with options don’t have to put up with this. While they may not find the same level of support on distant shores that we used to provide, the current cultural and political regression in the US will repel or drive away many of the best minds.

Government grants and support

Historically, the largest grant making agencies in the United States have been the Department of Health and Human Services (medicine), the Department of Agriculture (food science), the National Science Foundation (all fields of science), the Department of Energy (very sciency), and the National Endowment for the Humanities and its counterpart (cultural exchange), the National Endowment for the Arts (more cultural exchange).

All these agencies and dozens of smaller ones are being gutted (illegally). They provide untold billions in grants for basic science research and systems development that will no longer be available or will be severely disrupted in the short to intermediate term. In the case of the latter two, they support the bonds between countries aka our allies that make it attractive to the world to come here and research, build, and innovate.

The loss of funding will take a hammer to the research and development that attracts the best minds domestically and from around the world. This is bad for the economy because new and old businesses alike rely on basic science research to create new product categories and to develop new products and systems within categories that then belong to the United States intellectual property regime.

However, the disruption could be a potentially massive opportunity for other countries and their research centers. And the loss of talent, native and foreign, to other countries represents missed opportunity and a drag on momentum that will be hard to reverse.

Tariffs

The openness of capital flows and investment that support a mutually beneficial supply chain among countries is under attack with the erratic on-again, off-again imposition of tariffs that is shredding free trade agreements.

The tariffs announced yesterday apparently were based on a formula that had nothing to do with reciprocal tariff policy, but rather on trade deficits. This makes no sense.

The effects of indiscriminate tariffs are well known and have been for decades. Inflation and depressed trade flows means economies are under immense pressure.

The widespread prediction among many economists and investors is that we’re headed into a recession with accelerating inflation, i.e. 80s style stagflation.

USAID and other international programming

The far right and the far left both have a history of hating on USAID, but the fact is that it has been a major source of development and good will around the world towards the United States.

People underestimate the value of so-called soft power to drive economies. People in foreign countries buy American products not just on the basis of utility and value, but also because they aren’t otherwise repulsed by our policies.

USAID also utilizes in massive quantities American products to deliver programming to alleviate poverty, disease, and lack of opportunity. Those American companies will now lose major foreign markets for their products.

What to do about this

The only answer, apart from resisting in whatever way you can, is to further diversify. That means for me personally and many in my situation, allocating more capital to international investments.

My allocation is slowly going to build towards 25% of all my invested assets in international. While I could make this shift instantly inside my traditional and Roth IRAs, I’m making the moves slowly because I’m in the dark like everybody else regarding how bad this is going to get.

So much is out of our control. The political environment can’t be steered quickly away from the authoritarian direction we’re in. But slow electoral and other peaceful means can right the ship. Meanwhile, you have to protect yourself if you can. But you should be cautious about moving too abruptly.

I wouldn’t ever consider moving entirely to cash. Likewise, moving more towards international equities should be done gradually on a quarterly basis, usually in the first week of the new quarter. We don’t know how all this is going to play out. If it gets worse, you can continue to move more of your assets to international. If it stabilizes, you can stay the course and maintain your primary positions in US equities.

That said, some will want to move quickly. Some, like myself, will choose to go slowly. Pick your poison

Above, an AI render of a photo I took out my back door looking into Mexico. AI is yet another unknown disruptor apart from the bipolar presidency. Lord help us!